5 Immediate Ways to Fight Cybercrime

March 21, 2016Invitation Scaling Up Club – Marshall Goldsmith tomorrow live online

March 22, 2016How One Company Fast-Tracked Its Scale-Up

Setting clear quarterly priorities has helped Forum Equity Partners accelerate its rapid growth and introduce two new lines of business.

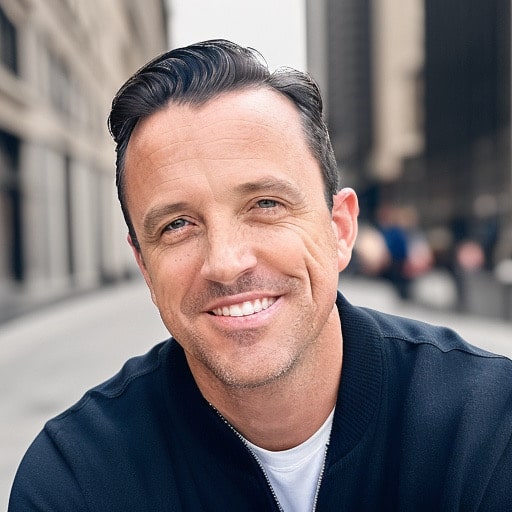

Richard Abboud has turned Forum Equity Partners into a fast-growing juggernaut. His development and equity investment firm has provided financing for high-profile projects such as the $82.5 million pedestrian tunnel to Toronto’s city airport, which is located on an island on the edge of Lake Ontario. Active in areas such as real estate, infrastructure and renewable power, the firm has built a reputation for crafting deals others don’t see how to do.

In 2012, it became clear to Abboud that the 20-year-old Toronto-based company needed to refine how it operates to continue to achieve the balance sheet growth he wanted and to scale faster.

Forum Equity Partners has financed many “P3” deals—short for public-private partnerships—such as arts centers, student housing, courthouses and prisons. However, Abboud felt a strong need to diversify into new areas to decrease risk.

“We really wanted to strengthen the backbone of the company and expand the business lines we’re in,” Abboud says.

Get a Coach

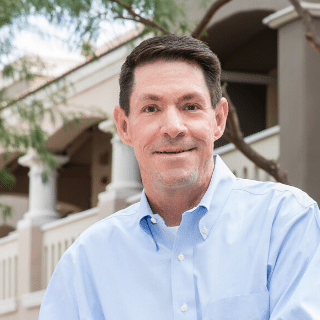

After attending a three-day Young President’s Organization event where I spoke in 2012, Abboud got interested in the Gazelles’ Scaling Up system for growing a company. “We wanted to put it into action,” says Abboud. To do that, he reached out to Les Rubenovitch, a Gazelles Certified International Coach based in Toronto, for guidance on implementing it.

After talking with Abboud, Rubenovitch encouraged him to build a management structure that focused on the company’s values, priorities and communication rhythms and clearly defined the culture to make sure it had the right talent.

Right People on the Bus

Rubenovitch introduced Abboud to Topgrading, a system for attracting and retaining A players who would help the firm continue to achieve its key metric: balance sheet growth. By 2014, Forum Equity Partners had hired seasoned HR executive Colleen Teed as vice president of people and culture. “She helped us implement the plan and bring the right people on the bus,” Abboud says.

As Forum Equity Partners moved forward with implementing the program, a new culture of accountability led to significant changes. “With Les’s help, we really focused on getting the right people on the team,” says Abboud.

Abboud experienced some uneasy moments during the transition. “Work still had to get done,” he says. “We’d experienced significant changes in the team and had a lot of new people.”

Rubenovitch advised Abboud to stick with the system, and Abboud remained committed.

Quarterly Focus

Forum Equity Partners also began setting quarterly goals as it worked with Rubenovitch. In one quarter in 2015, the goal was to overhaul the company’s IT system, which it achieved, says Abboud. In a previous quarter in 2014, the company established an internship program.

Gradually, the value of the new approach became clear. “We thought the structure would encumber us,” says Abboud. “It is the structure of quarterly objectives that liberates us.”

Rapid Expansion

With the right talent in place and a renewed focus, Forum Equity Partners was able to move forward at a clip.

So far, the team’s efforts have been working. “We have continued to achieve strong balance sheet growth since using the system,” says Abboud.

The average return on equity at the firm since 2002 has been growing a little more than 50% per year, “which we think puts us at the very top of our category,” says Abboud.

Meanwhile, the company has launched two new lines of business since working with Rubenovitch. In one new venture, it is investing in transmission development in renewable energy. It has also launched a renewable energy investment business with an office in San Francisco.

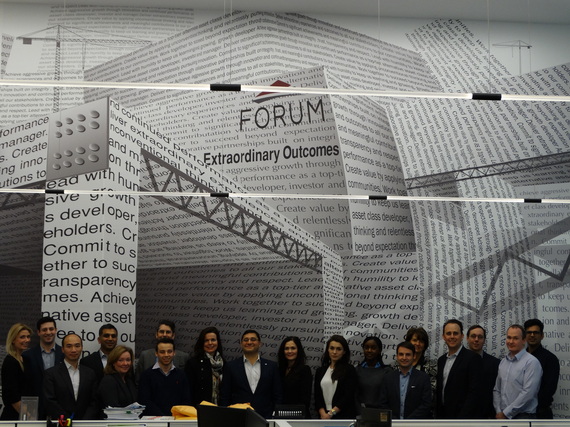

The company has grown so quickly it moved into a spectacular new office recently, complete with electronically controllable standup desks and a standup meeting room. A 30-foot-high, 3D mural in the shape of buildings identifies the company’s values and other key information.

Rubenovitch sees this as the ideal setting for the future growth he foresees for Forum Equity Partners. “They are extraordinarily proficient at identifying the right priorities and flawlessly executing them,” says Rubenovitch. “It’s an excellent capability.”