How an industrial roofing company 10xed its revenue in five years

January 11, 2024Storywizard wins biggest ed-tech competition in world

January 31, 2024By Verne Harnish

When the Covid lockdowns struck, LAVU—a restaurant point-of-sale and payments company based in Tampa, Fla.—was hit hard. Its target market is high-growth, independent restaurants.

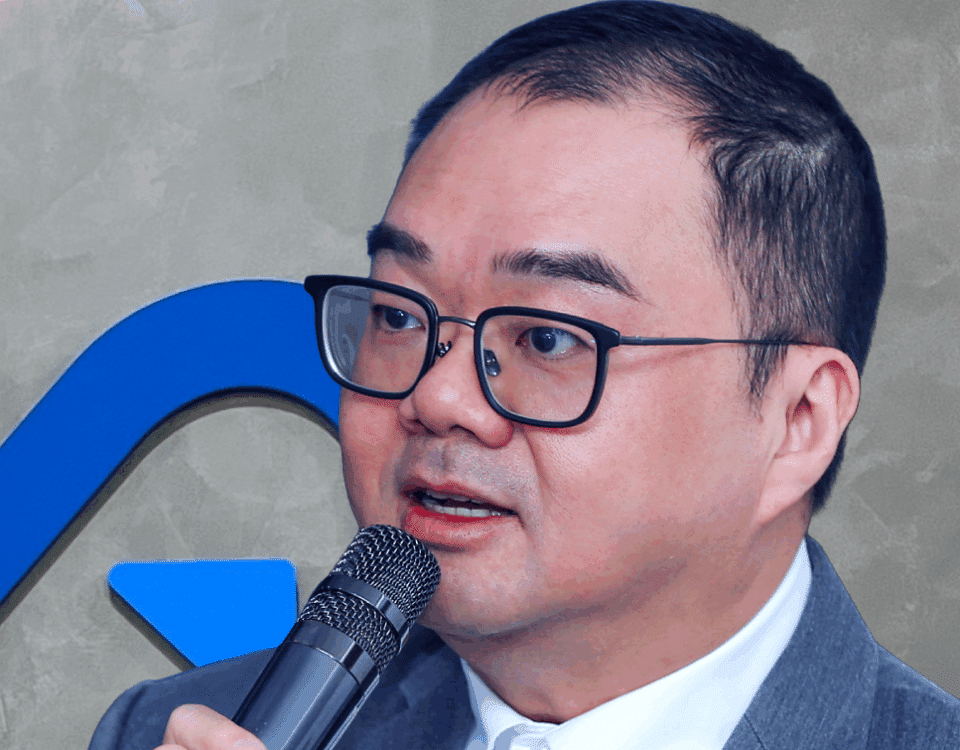

“We lost 30% of our business, with restaurants going out of business,” says CEO Saleem Khatri. Founded in 2010, LAVU describes its product as the first iPad-based restaurant point-of-sale system. The company, which in 2018 brought in $8 million in sales, saw its presence decline from 90 countries to 50. It had to cut 50% of its then 250-person U.S. workforce.

Looking back, Khatri says, “We took the world’s greatest punch, and we came out the other side…and that gives me all the confidence in the world.”

Despite that challenge, Khatri managed to scale the company. The now-130-person company has grown revenue by 74% year-over-year and is highly profitable.

It wasn’t an overnight success. “You’re working, working, working—and then all of the pieces you’ve put into place start working together,” Khatri says. “That’s what happened to us.”

Scaling Up Certified Coach Jennifer Walzer Berkowitz at R&J Advisory Group guided Khatri on how to pull it off. Khatri had been promoted to CEO from a role in finance and business development in 2018 when private equity firm Aldrich Capital Partners acquired LAVU. He met Berkowitz through a contact in the Young Presidents’ Organization (YPO). Berkowitz previously founded BUMI (Backup My Info Inc.), a backup and recovery business in New York City that served the financial industry and grew to multimillion-dollar revenue.

Mastering the CEO’s role

Although Khatri found there were many steps to scaling up, he says, “The single biggest lever is putting the right people in the right seats doing the right activities right.”

That started with himself. One of Berkowitz’s first steps as a coach was introducing him and his leadership team to the Scaling Up platform. Although Khatri attended Harvard Business School, he says, “I had never seen a book that literally teaches you how to run a business. I have many textbooks that line the wall in my library, and I had never seen a book that says ‘Do this. Then do this. Then do this.’ I was always left to go on the Internet and figure it out when I had an issue. Scaling Up gives you a manual.”

As he read Scaling Up, he found it helped him to understand the role of the CEO in specific detail and focus his attention on what mattered most.

“The book tells you what the job of a CEO is,” says Khatri. “When you come into the role, you know you have to grow the company and make sure things are working well.”

The book says the job of the CEO is setting the Strategy, which includes Vision—and, he notes, getting the capital and the people to go and execute on this.

Hiring smarter

Khatri also fine-tuned the company’s hiring processes to find more team members who have a founder’s mentality about growth—people, he says, “who are hungry, humble and smart.”

They also need to be able to fulfill the requirements of the role. A VP, for instance, needs to be able to recruit other people. “You have to understand the role and what the person is supposed to do,” he says. That means asking the right questions. “So, if I’m hiring someone for engineering, what is the problem to solve in engineering?” he asks. “Have they tactically done that? And do they want to do it again? Are they attracted to solving those types of problems?”

Khatri turned to the Topgrading platform to find the A players he needed. “I believe typically good leaders are hired for 12 – 18 months and then, if you’re doing your job right, the company company is scaling,” he says. “If we are growing at XX%, I have to be better than that, and my leadership team has to scale with the growth of the company.”

Aligning a team

As the company made strategic hires–including vice presidents of customer success, engineering, finance and sales– Khatri also made sure to attach the company’s KPIs to specific names. The KPIs all funneled into the company’s big-picture goals. This ensured that everyone was rowing in the same direction. “If there isn’t a name attached to a goal, there’s no accountability,” he says.

To keep LAVU’s team aligned, Khatri holds a two-hour weekly “deep dive” leadership team meeting, where members borrow a strategy from YPO to clear the air with other members. “This forces conversations and communication outside the meetings,” says Khatri. There is also a three-times-a-week huddle.

Khatri also found creative ways to celebrate the achievement of these milestones, such as a sunset cruise around Tampa Bay, where many employees live. The trip included not just the sales team but also the employees who install and connect LAVU’s systems and support the customers, who are just as critical to the company’s success.

“Business is a continuum of activities,” he says. “To grow like crazy, everything has to be humming at once. It’s like an orchestra.”

Winning through customer service

Knowing that most local restaurant operators don’t have time to deal with a point-of-sale system that malfunctions, LAVU makes sure its own is up 99.9% of the time.

In the event there is a glitch, LAVU has made tech support an area of differentiation, investing in well-trained team members to guide its customers in an approach driven by the fundamental tenets of hospitality that looks at factors such as first-call resolution, resolution time, abandonment time, Customer Satisfaction Scores (CSAT) and Net Promoter Scores (NPS). “You can’t improve what you don’t measure,” he says. His team jokingly refers to this overall approach as PDP, as in “Pick up the d*mn phone.”

“Why are restaurants coming to us? It’s because we pick up the phone,” he says. “We talk to them. We treat them like human beings.”

That approach has led to word-of-mouth referrals and has helped to improve the company’s cash position. “Being able to grow your cash balance every single month is really important,” he says. “You need to be able to grow efficiently.”

Improving customers’ bottom line

LAVU has also helped restaurant operators manage their overhead—a significant benefit at a time of inflation and high labor costs. Its products allow them to offer a discount to customers who pay with cash instead of by credit card. If they opt for a credit card, it costs 3-4% more. “That falls straight to their bottom line,” he says.

Getting restaurant owners to make changes to their operations isn’t always easy, as Khatri has found. Many are creative people who like doing things their own way. However, once they do embrace new technology, he finds, “they can survive and thrive.” And by helping them grow their businesses, LAVU, in turn, is scaling up by leaps and bounds.